News Articles

Our Articles

Posted on 6 July 2021

Posted on 6 July 2021

Posted on 6 July 2021

Posted on 6 July 2021

Introducing NAYAGA Exchange Traded Fund

Posted on 6 July 2021

Cakratech’s Product:

NAYAGA Exchange Traded Fund

We’re introducing one of our products called the Exchange Traded Fund. It’s also a part of a mutual fund.

Exchange-Traded Fund (ETF) is a type of security that involves a collection of securities insisting on stocks that often track an underlying index. ETF is a Mutual Fund in the form of a Collective Investment Contract, the units of which are traded on the Stock Exchange. ETF is the combination of mutual funds in terms of fund management with the share mechanism in terms of buying and selling transactions.

Exchange-Traded Fund is a type of investment fund and exchange-traded product, i.e. they traded on stock exchanges. ETFs are similar in many ways to mutual funds, except that ETFs are bought and sold throughout the day on the stock exchanges while mutual funds are bought and sold based on their price at the end of the day.

Why Nayaga ETF?

Cakratech as a Vendor IT solution has focused and has more than 10 years of experience in the Capital Market Industry which we provide with our main product called NAYAGA with other IT services. In 10 years of experience in the Capital Market Industry, we’ve been experiencing the various product and implementation credentials with a comprehensive, robust, and proven approach to developing and implementing a flexible and scalable solution.

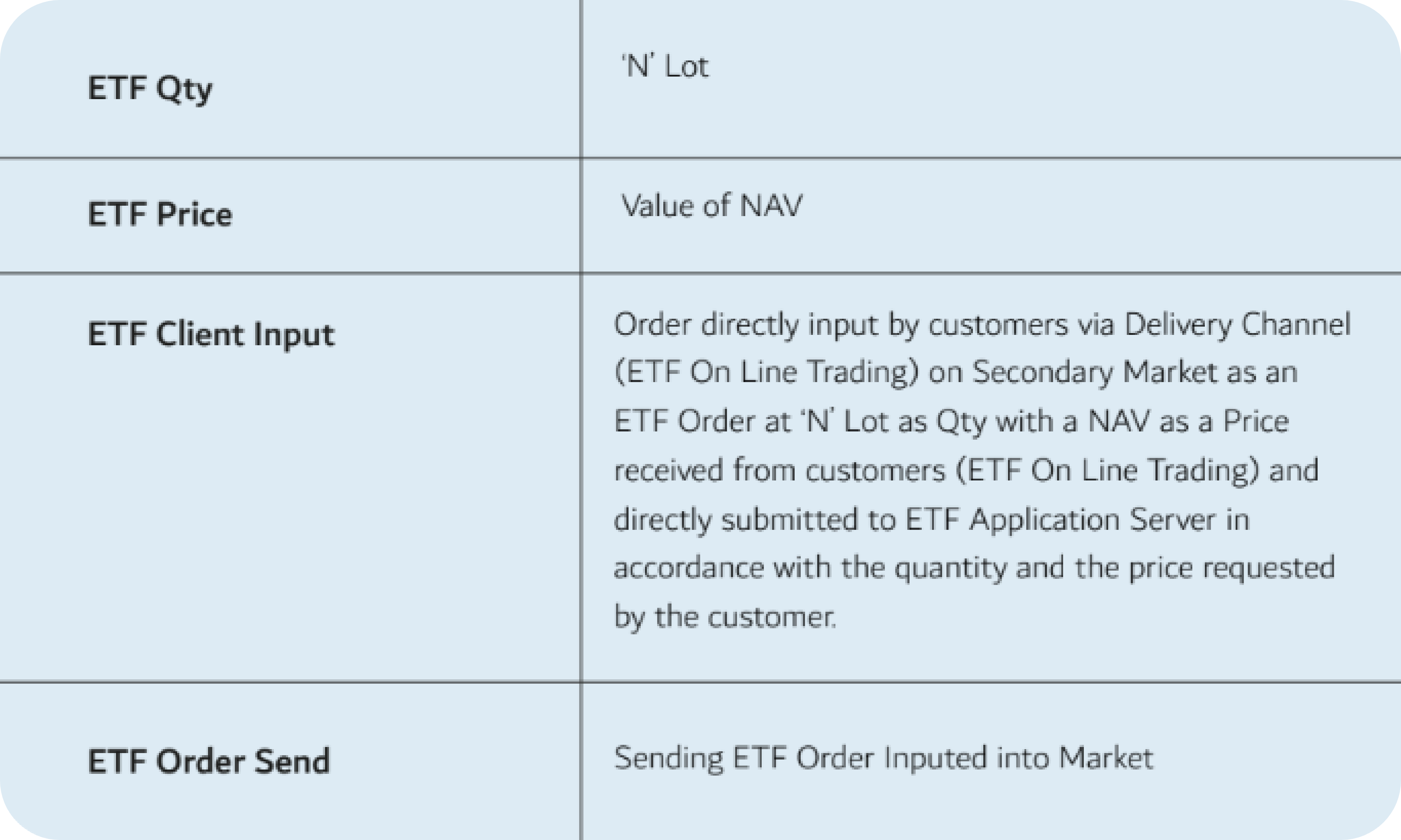

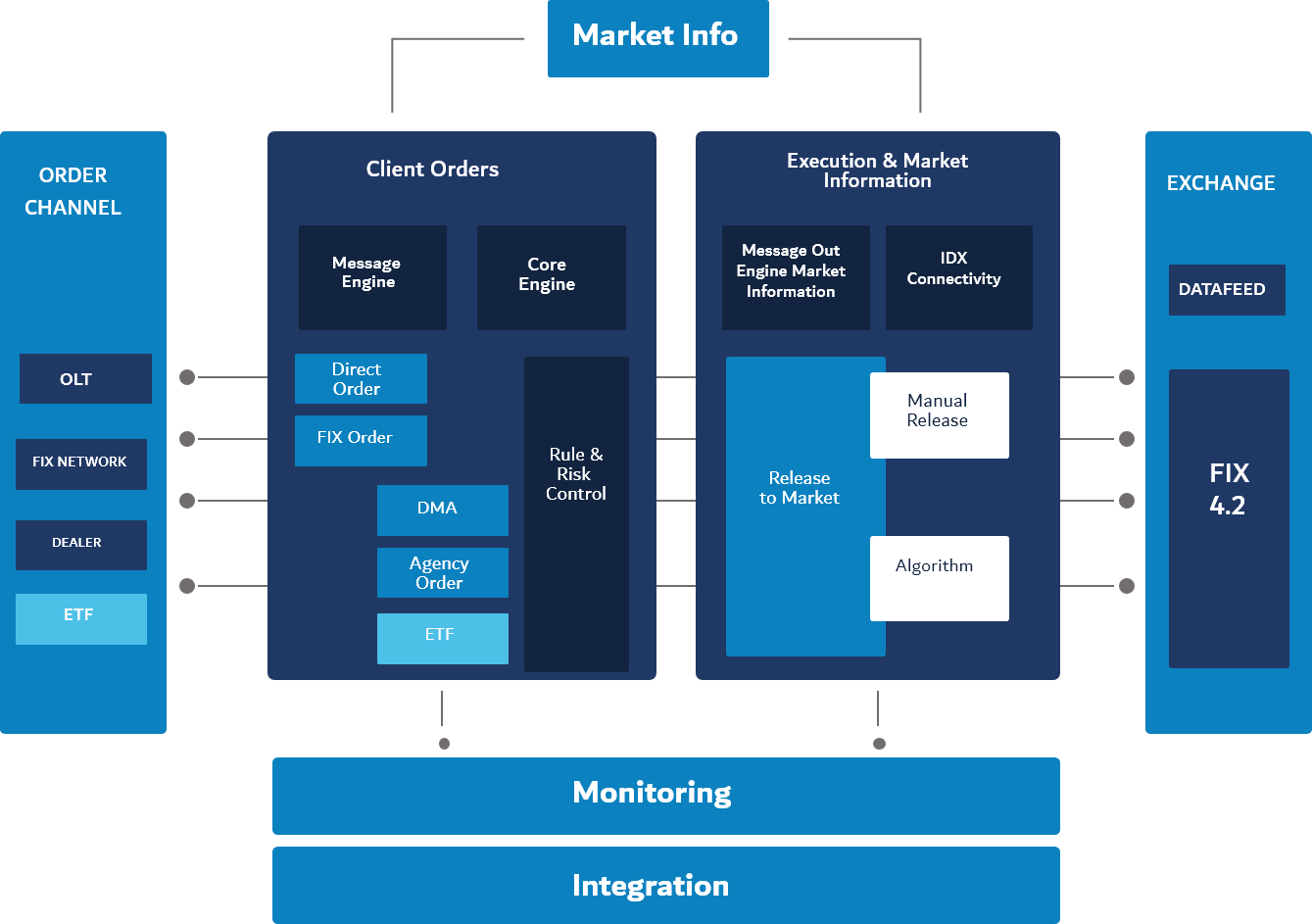

NAYAGA-ETF as a part of NAYAGA-TRADING Platform that has been developed with the capabilities to manage Multi Type of Channel, Multi-Product and Multi Type of Order, which can manage the transaction through Online, Dealer, FIX Network and ETF as a derived product and channel.

NAYAGA-ETF equipped with the ability of ETF Order Handling on the Primary and Secondary Market, Price Engine to manage the fulfillment of Order release to market by getting the automatic price of the market and provide the calculation on the indicative NAV (i-NAV) on a real-time basis as a part of ETF Market Info.

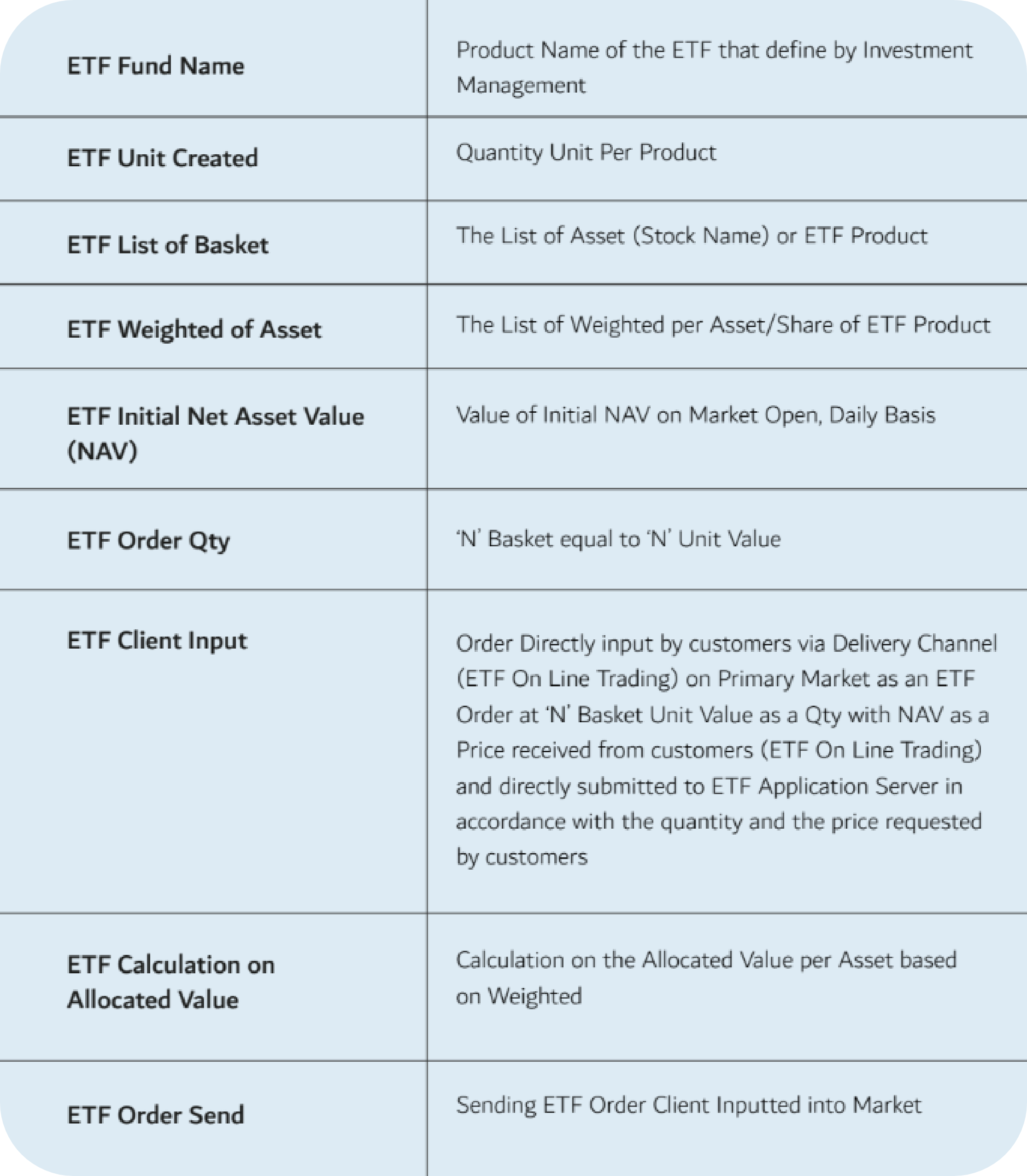

Trading Mechanism

There are two types of trading mechanism, the mechanism and order handling

manage by NAYAGA-ETF engine is:

- Order on the Primary Market

- Order on the Secondary Market

- Order on the Primary Market

- Order on the Secondary Market

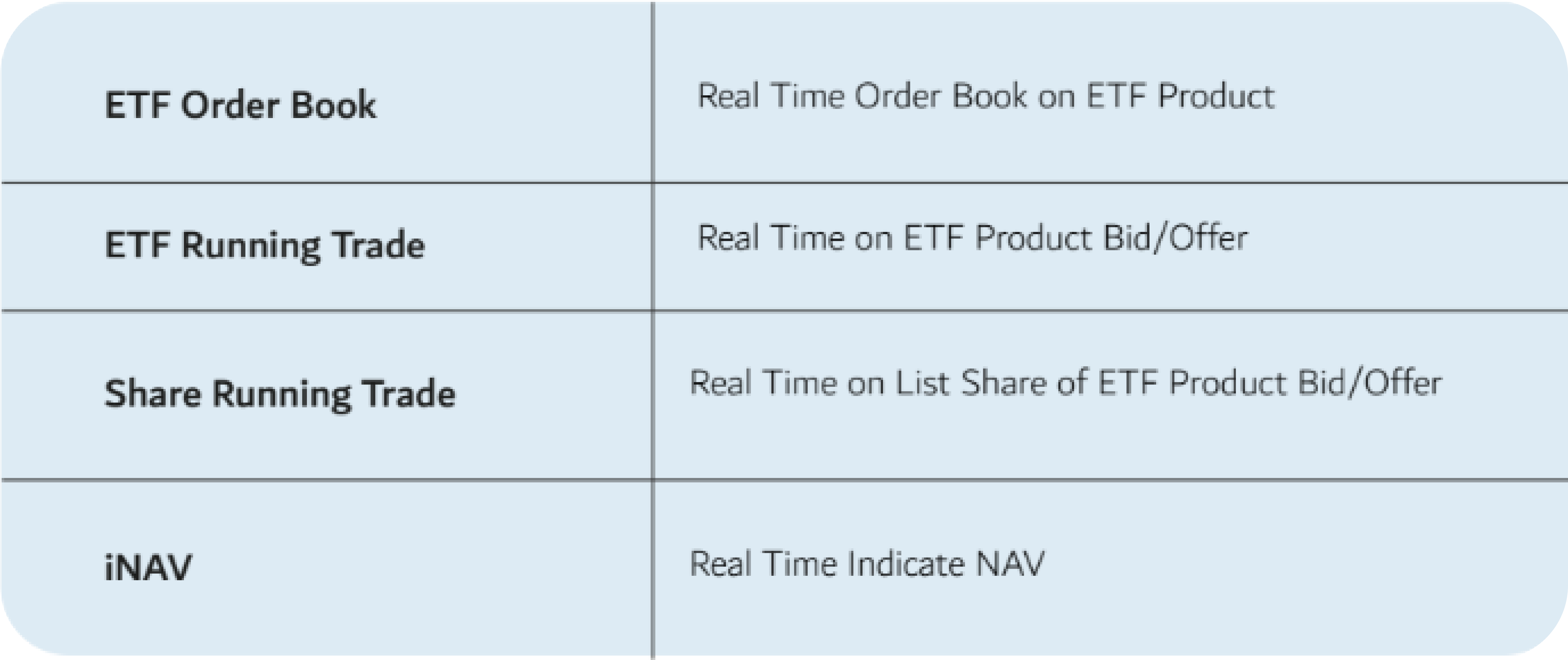

- ETF Market Info

These orders that have been ordered are going to be sent by Electronic (FIX Network), Manual (Phone, Email), and the system is provided by Sell Side.

Investment Order Type

1. Conventional Stock

2. Exchange Traded Fund

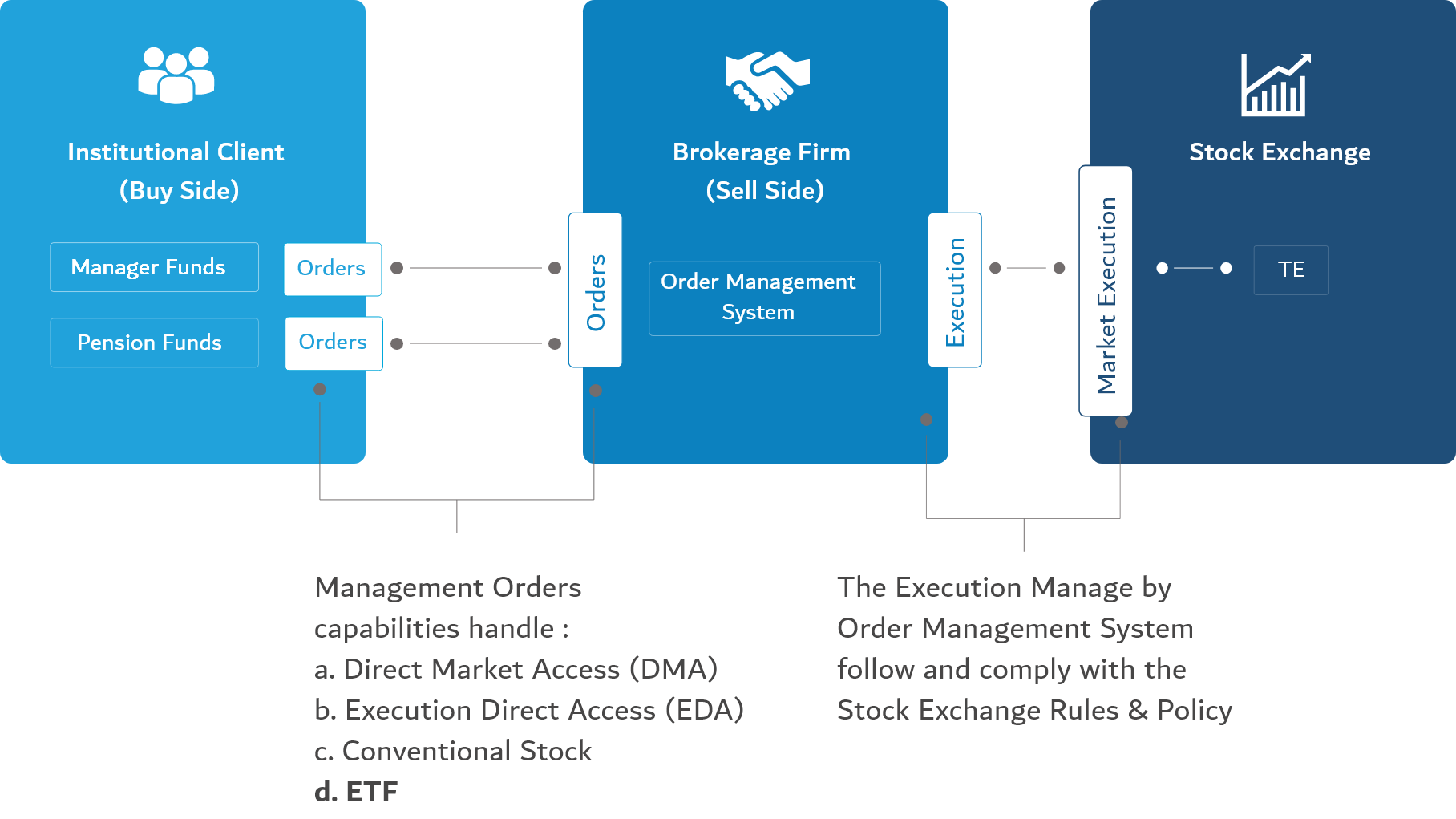

The diagram below is explaining the whole details of the Trading Mechanism Buy Side & Sell Side

Core Trading System

The Core Trading System for the ETF uses our main core system NAYAGA Order Management System (NAYAGA-OMS) to Manage the Orders.

Channel

To Manage Trading Capabilities or orders from Sell-Side and Buy-Side these components working together to make the best trading results. Also, there are several types of order consists of :

- Direct Order

- FIX Order

- Direct Market Access

- Agency Order

- Exchange Trade Funding (ETF)

Advance Features

NAYAGA-OMS Capabilities available on the New

NAYAGA-OMS Version using RabbitMQ.

Additional Engine Required consist of,

- Nayaga-Price Engine

- NAYAGA-Basket Order

- NAYAGA-SMART MI

To be embed into the New NAYAGA-Platform in purpose to able to manage:

ETF Market Info included NAV & i-NAV

Real-Time ETF Order Book, ETF Running Trade, Stock Running Trade on the List of ETF and NAV & iNAV.

ETF Order Handling

ETF Order Execution

To release the Order for a List of Asset/Share of ETF Product will using the Basket Order Module on the NAYAGA-OMS The New version of NAYAGA-OMS provides a better

service in handle ETF Orders,

- Targeting to Direct Match (Order Fulfilled Immediately)

- Auto Crossing odd lot

- Real calculation indication NAV

- Simulation Target NAV compare to Basket Volume

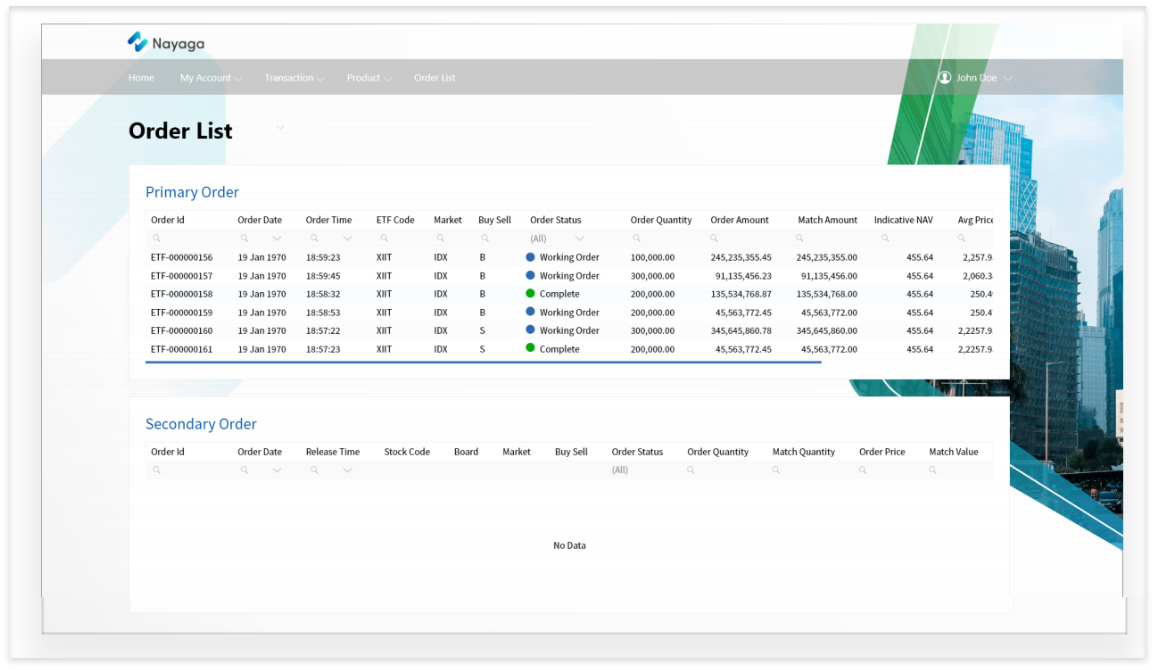

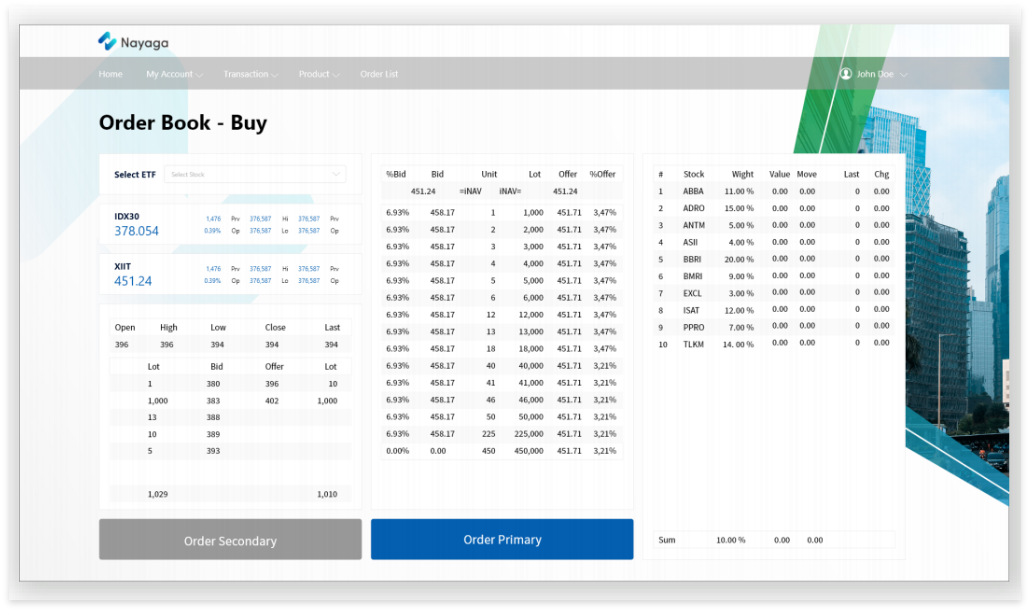

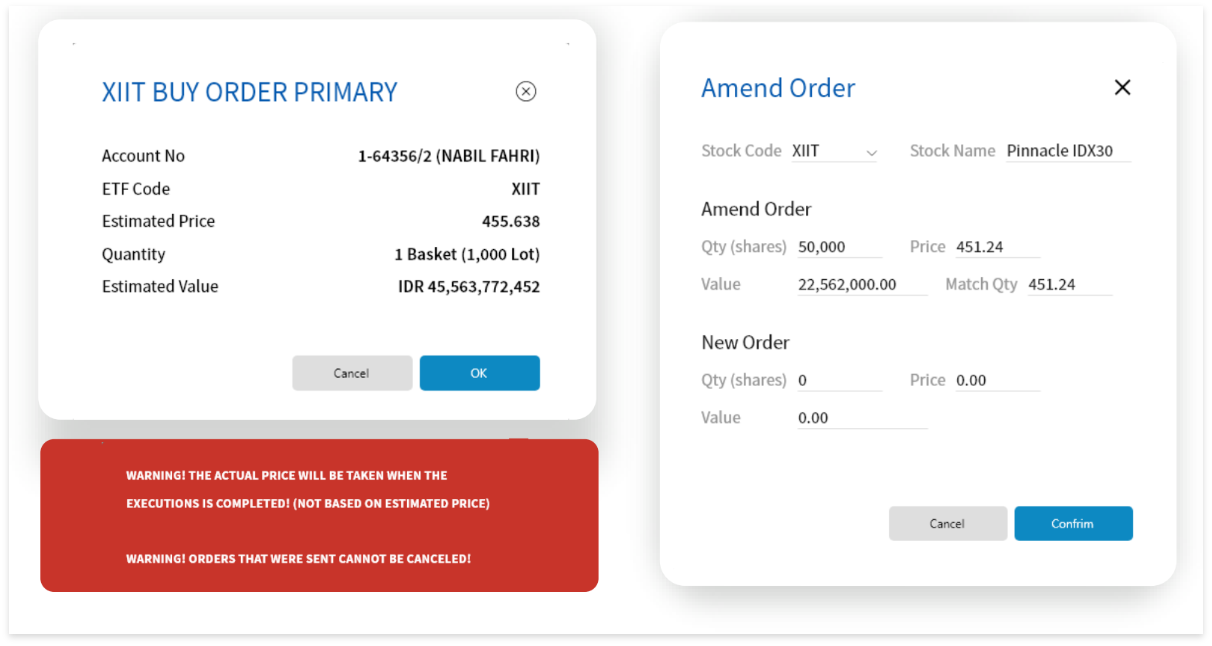

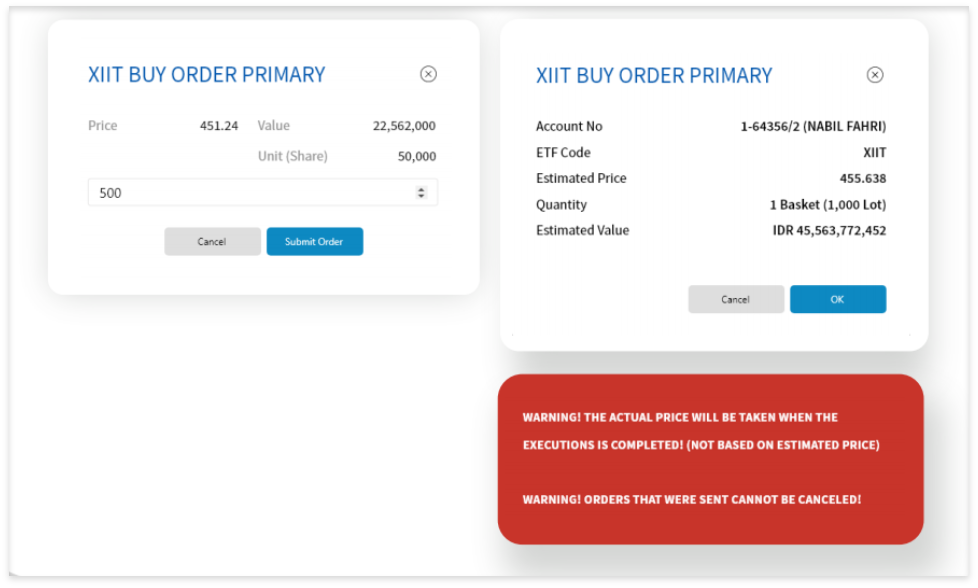

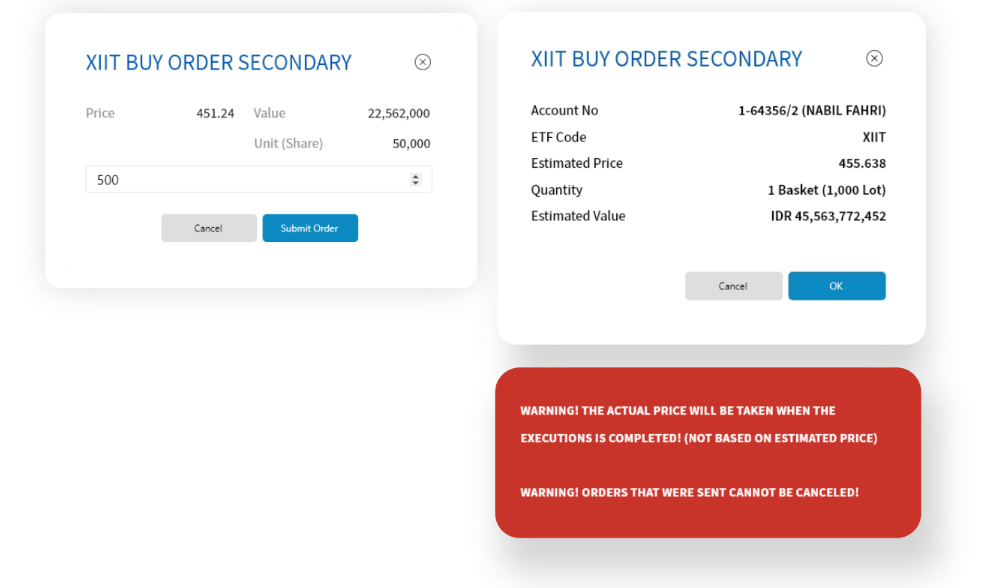

UI Design for NAYAGA ETF

Order List & Order Book

Buy & Amend

Buy Order Primary

Buy Order Secondary

Pretty easy right? Are you interested in jumping down and discussing more your business with us?

Best Regards,

![]()

Contact us for more info,

Email: info@cakratech.co.id

Check out our website: https://www.cakra-tech.co.id/

Let’s discuss and work together with us. We're always ready to solve all your IT issues!